Leapfrog Bank, Rise of Indian digital payment

Published: December 18, 2017

Summary

Mobile payment in India is expected to evolve drastically like China. People will be majority in India, who start all kinds of things such as the Internet, banking, ID etc from mobile. Money transfer is an important function making up the contemporary economy. If money transfer ride on digital infrastructure, Indian digital economy will be one of the most progressive among the world. The country will be able to leap-flog experiences of rich countries

Digital settlement in India is developing with e-commerce. According to the report by BCG et al., it is predicted that digital payments in India will reach $ 500 billion (about 55 trillion yen) in 2020.

The mainstream of mobile payment is prepaid type. Charge money from a bank account or a real store agent to Mobile Wallet. One of the main uses is to use the charged money for e-commerce. e-commerce and digital payment have a close relationship. Like eBay acquired Paypal at one time, Alibaba raised Ant Financial into the world's largest FinTech company.

In India, online retailing is growing despite the fact that real retailers are developing. It is a different process from rich countries where online retailing has grown after real retailing has developed. There is a possibility of more radical growth of online retailing in India. It is the same scenario that Alipay has penetrated in China.

vThe other is payment using code in real retail. Mainstream in India is QR code type payment which is same as Alipay or WeChat Pay, requiring only smartphone possession for users. The initial investment imposed on retailers and customers is just buying mobile and downloading mobile app. A street vendor who sells a single item, for example, shows the customer the wallet public key. After customer read and enter the amount, the payment is done. The street vendor can confirm the transfer of the amount of money by the application instantly.

How can digital wallet fill the world? First we will need a process to convert banknotes into electronic money. As soon as all the money exist on the digital, it may be possible to complete every money transfer on digital.

The reason the central bank controls money will be suspicious in the future(actually, IMF says so). We are living the era after the global financial crisis and monetary easing. It is obvious that Internet-derived money is better suited to digital wallet.

Take ”Unbanked” to Digital Banking

Mobile Wallet is to open the way for digital payment to "Unbanked" (a person who does not have a bank account). Besides, there is no need for "legacy tool" such as credit card or bank account, if you give a smartphone with Sim to the unbanked, they are invited to digital banking. In emerging countries where leapfrog occurs, inefficient legacy finance may not be developed.

Payment without high cost legacy infrastructure is beautiful. The transfer of money is recorded on database made up of contemporary technology. Sophisticated distributed processing gives certainty and redundancy to deal tons of transfer records. Admin monitors transactions gathered from a vast network based on high security. The real time balance is reflected sequentially to wallet on the edge.

Population of India is 1.3 billion. There are no IDs in low-income groups who belonging to lower caste or converted to Muslim, Buddhism and Christianity with dissatisfaction with the lower caste. Some people do not exist on the civil registry. They have no access to banking and education. Possession of cash is dangerous sometime in emerging countries such as India. A lot of counterfeit notes are also circulated.

If they get the mobile, they may become people who acquire a digital ID and exist. You may be able to receive subsidies directly with digital wallet. There is no room for civil servants and local bosses to cheat on subsidies. People also reach educational opportunities on the Internet.

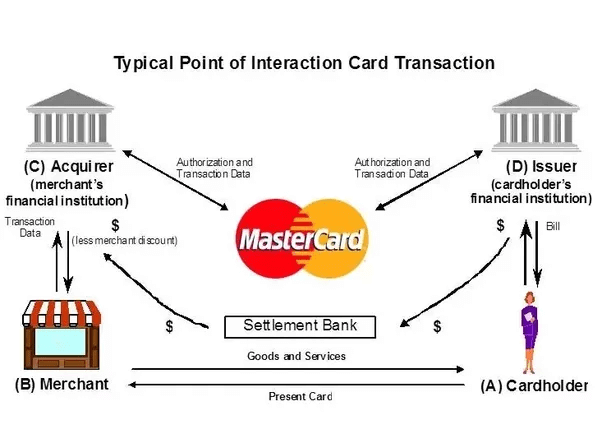

The challenge of legacy payments common in rich countries is that 1) too slow and 2) too many stakeholders. At least three financial institutions (Issuer, Acquhirer, Settlement Bank), and Brand (VISA, American Express, Master etc.) are involved in the creditcard transaction. If it is complicated, more stakeholder are involved. These companies share several percent of commissions. Japan has unique situations, but it is not explained here.

Fig01 Credit Transaction Structure via Master

Fig01 Credit Transaction Structure via Master

In rich countries the number of stakeholders is big constraint on the spread of digital wallets. Digital wallet reduces stakeholders and improves efficiency. That is why stakeholders of existing systems can not agree with transition to contemporary system. In Japan, "economic sphere" and "series" enhance restrictions.

The exclusive mobile payment platform significantly reduces the need for interbank payment and settlement system. The number of stakeholders decreases and the fee falls drastically. Contemporary infrastructure guarantees speed. India is following this “China scenario”.

In China, Alipay, WeChat Pay developed the system. Cooperation with existing financial institutions and retailers is wonderful. They also kept the "taxes" imposed on users low. Alibaba has a huge value chain of e-commerce. Tencent also has a solid revenue source of social media empire and game platform. It is rational for profitable company to monopolize the market. It seems that logic different from anticipated antitrust laws has worked.

In the Internet business where the marginal cost is very small, startups are given the opportunity to implement strategy targeting dissatisfaction for “high tax rate” when monopolies impose excessive taxes on users. Unlike other industries, startup companies can expand their business with small additional cost, and the development of direct finance and cloud computing is accelerating it.

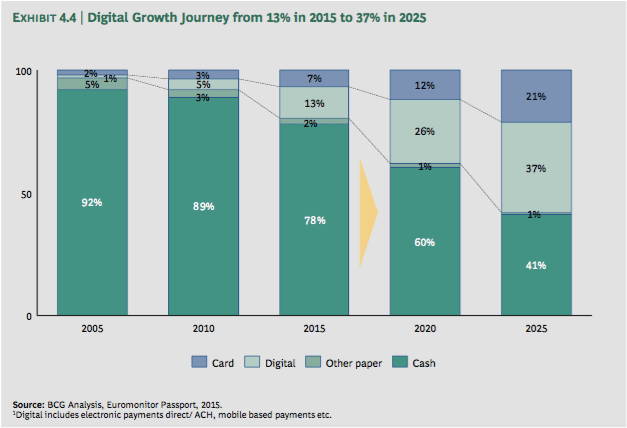

Indian digital payments are growing rapidly. "BCG-Google Digital Payments 2020" predicts that Indian digital payment transaction amount will reaches 500 billion dollars in 2020 . The report predicts that the proportion of digital payment as a whole accounts for 37% of total payment in 2025 In India.

Fig02 Source :「BCG-Google Digital Payments 2020」

Fig02 Source :「BCG-Google Digital Payments 2020」

In number of transaction, prepaid mobile wallet maintains double the growth rate of traditional mobile banking. It can be assumed that Mobile Wallet penetrates low-income class without bank account. For the fiscal year 2014 and the year 2015, ATM and cash account for about 70% of the total payment, but the growth rate of the digital channel is 50-52%, overwhelming other payment methods. 2016, 2017 seems to indicate more rapid growth, reflecting mobile wallet vendors keep improving infrastructure.

The report pointed out following trends over the digital payment.

- Payment drives consumption: Payment allows enterprises access to customer transaction data. It enables payment service providers to offer other financial service, suggestions and coupons to consumers.

- Consumers are demanding a small number of ubiquitous payment solutions. Niche solutions are urged to integrate into other companies

- Integrated payment interface (UPI) can be a game changer: UPI provides seamless compatibility between service providers and drives the scale of digital payments

- Partnership are extremely important. Partnerships to lower customer acquisition costs are essential

- ”Beyond Payment”: Payment operators can expand customer relationships by providing financial services in general and consumer-based products

Narendra Modi, President India Prohibit usage of high-value bill at the end of 2016. In India, downside of banknote is clear such as counterfeit bills, money laundering, tax evasion, and outflow to black market.

NPCI (National Payments Corporation of India) established a standard called UPI (Unified Payments Interface). Thanks to this standardization, people can use multiple mobile payment platforms with one mobile application. You may be able to make dutch treat among different applications, and payment in digital commerce service is completed only with in-app payment that you don’t have to get out of the app once. It is a measure to prevent system fragmentation as happening in Japan.

Facebook, Google and Amazon got permission for payment service from NPCI. Facebook is trying to customize WhatsApp into WeChat. It is time for the US tech giant to imitate the trend China giant made.

According to RBI, 9.2 million transactions equivalent to Rp 27.7 billion as of May were processed through UPI. As of June, 10.2 million transactions equivalent to 30.7 billion rupees (about 54 billion yen) were processed through UPI. Average is around 2700 to 3000 rupees per transaction. NPCI has tried to lower the average amount per transaction. And it Invite small payments to UPI, which is the mainstream in India.

"Hike Messenger" is the first messenger application with payment function in India. Before WhatsApp. Hike Messenger is financed by Tencent.

According to estimates by Mobile Association of India and IMRB International, the number of Internet users in India is between 450 million and 465 million as of June 2017. WhatsApp announced in February 2017 that MAU (monthly active users) reached 200 million.

Local banks are also trying to catch up. They develop mobile application and Internet banking. From a bank perspective, mobile applications made by technology companies can swallow market banks are having. If the cashless economy is achieved, “bank account" for individuals will vanish.

Will Paytm accomplish critical mass of Paytm?

Paytm Ant Financial back Mobile Payment company is at pole position. Softbank also invested $ 1.4 billion in Paytm in May 2017.

Since the prohibition of high-value banknotes, demand for mobile wallets has expanded. From December 2016 to January 2017, Paytm expanded its user base from 150 million to 180 million. Paytm claims that the number of transactions also recorded 200 million in December 2016, exceeding the transactions of all creditcard companies in India. In the future, how to educate small-scale merchants is going to be key factor of high growth rate. Paytm has launched an entry model with a usage limit for small merchants.

__One97 Communications(Paytm) Founding __ May, 2017 $1.4B / Undisclosed SoftBank Mar, 2017 ₹2.75B / Secondary Market Alibaba Dec, 2016 ₹3.25B / Secondary Market — Aug, 2016 $60M / Venture Mountain Capital Sep, 2015 $680M / Undisclosed Alibaba Feb, 2015 $200M / Undisclosed Ant Financial Oct, 2011 $10M / Venture Sapphire Ventures Jan, 2009 undisclosed amount / Private Equity — Oct, 2008 $25M / Venture —

The unit price per transaction is estimated to be lower than the credit card used mainly by the wealthy. However, the volume zone in India is small amount payment. The rapid growth of transaction number can be said to be a great possibility.

One 97, the company running Paytm was approved as "Paytm Payments Bank" by the central bank in January 2018. That is second “Payment Bank” approved in India after wireless carriers, Airtel. Payments Bank is legal status in anticipation of non-traditional financial institutions participating in the banking industry. The central bank is paying attention to businesses providing digital wallet fitting UPI. FinTech Player like Paytm can start consumer financial services with permission of Payment Bank. Paytm Payment Bank suggest online transaction, which is extremely innovative compared to the situation in Europe, the United States and Japan.

Alibaba invested 177 million dollars in Paytm Mall apart from Paytm itself. Paytm Mall is promoting the use of its settlement service without adopting "cash on delivery" which accounts for 60 to 70% of e-commerce transactions in India. Paytm Mall has just started to improve logistics bases. India has extensive landscape but logistics infrastructure is vulnable. It is far behind Flipkart and Amazon investing logistic network for a long time.

Amazon and Flipkart do not carry Paytm's payment. Amazon received a payment wallet license from the central bank in April and added about 20 million dollar capital to Amazon Pay. Amazon has acquired "parts" for building Indian Ant Financial, such as acquiring a loan agent mobile application. Flipkart also owns Mobile Wallet Phone Pe which it acquired.

Two powers of e-commerce, which has huge demand for online payments, has built a proprietary payment platform. Paytm will be kicked out of the market unless it has a commerce business.

Urtilise China’s Precedent

Indian Many mobile wallet providers including Paytm are tracing China's precedent very quickly. China is the most progressive in the world in this area. According to Forester Research 's data quoted by FT, mobile payment transactions in China in 2016 doubled year on year, reaching more than 5.5 trillion dollars. It is 1.2 times the size of Japan's GDP, and is 50 times the US mobile payment transaction amount. Forester forecasts that China's mobile payment transactions will exceed $ 12 trillion in 2019 . It clearly tells us that China is leapfrogging over developed countries.

For example, Yuebao is the world's largest money market fund (MMF) operated by Alibaba Group. Yuebao is available from Alipay's mobile application from 1 yuan. Users can deposit and withdraw money at any time by fingers tap on the mobile. The user uses Yuebao as bank account in mobile with "high interest rate". MMF's expansion to the world's largest scale is attributable to the creditworthiness and convenience of China's largest enterprise Alibaba in addition to the low interest rates of state-owned banks' services and deposits.

Alibaba operates its own credit score "Sesame Credit". Uniquely score that person's "credit" from commerce, financial transaction history / net behavior history, payment history of utility bills, demographics, social networks. Alibaba backed damage insurance "ZhongAn Online" urtilise the credit score to determine the premium. This score is also used for transaction lending for e-commerce merchants, and hierarchy in availability to various services provided by Alibaba.

Conclusion

India is trying to eliminate banknote. A comprehensive digitization of business transactions in india can be more drastic than that in china. The Unbuncked can get digital wallet with ownership of mobile phone. This means that the network effect works on the service provider side. Only a handful of players are predicted to win

Suggestion

- If the cryptographic currency or decentralized electronic money expresses sufficient performance, it will enrich the economy to convert the currency to them (still underperforming currently). Most of financial institutions tend to be inefficient Middleman. It is beneficial for economy for the institution not to be present from the beginning. The core value of FinTech is disrupting less productive financial institutions. India should take advantage to exploit the lesson of precedent and leapflog the process as much as possible.

Eyecatch image via ajay bhargav GUDURU